These five areas have one thing in common: None of them will take off in scale anytime soon and they will therefore not be the short-time cash cow that many MNOs have been hoping for.

If we look at previous generations of mobile networks, the situation has been similar. Before 2G took off, GSM was pointed out as an economical fiasco by many media channels. No one expected SMS and MMS to be killer apps and that every single person would carry a phone a few years later.

With 3G, the expected use cases were highly influenced by the bandwidth-limited Wireless Application Protocol (WAP) that was released in 1999, and marketing activities were therefore centered around narrow bandwidth use cases like ”what is the value of this stock?” and ”how much does this product cost?”. A few years later, the iPhone was released, and it paved the way for actual business models like the mobile Internet, the avalanche in data usage, app stores and over the top services that mobile operators have been able to profit from.

4G was less of a tombola. The result of smartphones flooding the market in 2009 while 4G was rolled out for IP based Internet traffic made it a trustable investment. However, it was not broadcast/multicast video, other IP Multimedia System (IMS) services or acquired media companies that generated revenues for mobile operators. Instead, third-party video platforms from Netflix and Youtube have been driving traffic in the networks.

With all this in mind, a fair bet is that new, yet blurry application areas will drive the usage of 5G networks. We acknowledge 5G to be the wireless infrastructure that will fuel macro economies for many years to come in a world where wireless becomes the norm, but asking someone to build a nationwide network with tens of thousands of sites without a visible business case is challenging.

Also, if we look at what customers, device manufacturers, application developers and service providers really are asking for today and will need tomorrow, it is not lower latency, higher bandwidth

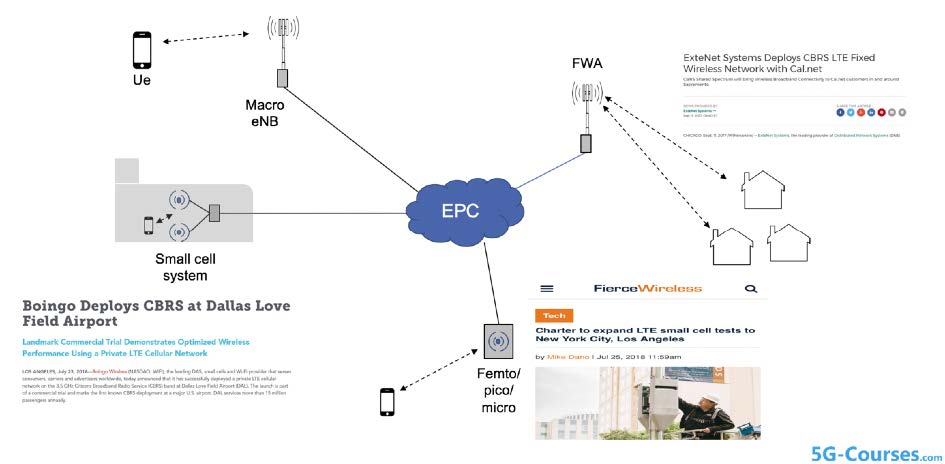

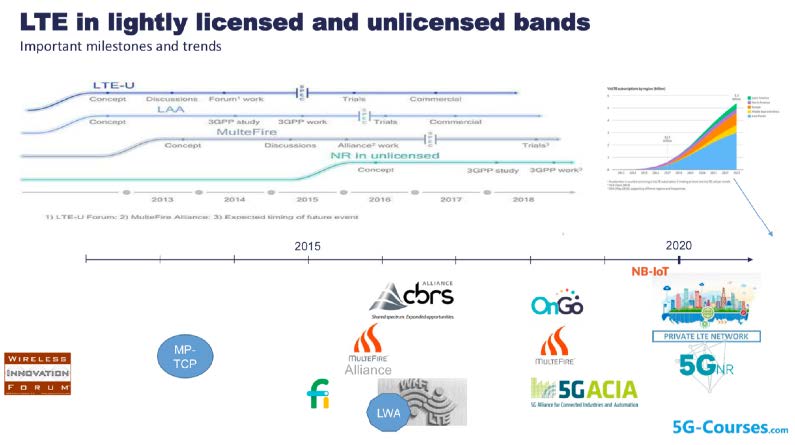

or a 5G icon on their screen but better coverage and higher network availability. To be able to deliver this, an MNO needs to find ways to build a more dense footprint in a more cost-efficient way. Fortunately, 5G brings tools that could help with that.

What we focus on in this article are three ”silver bullet” areas to help an MNO establish a long-term 5G presence and become relevant for device manufacturers, service providers, enterprises, industries

and other verticals who want to get access to reliable and ubiquitous wireless connectivity. The aim is to provide ”coverage everywhere” in the long term while revenues are secured short-term.